Rising Energy Needs Push Geregu Power Revenue to New Heights — Up 85%

Geregu Power Plc, a publicly listed electricity generation company in Nigeria, reported an impressive 84.7% jump in earnings for the second quarter (Q2), driven by rising energy consumption across the country.

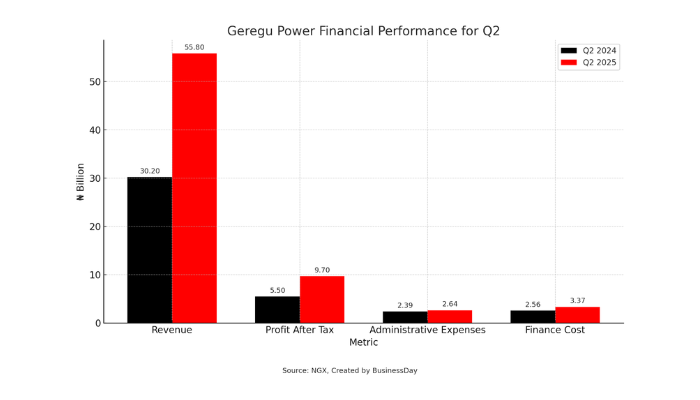

The company’s revenue climbed to ₦55.8 billion, up from ₦30.2 billion recorded in the same period last year. Notably, energy sales accounted for 64.1% of this total, highlighting the growing demand for electricity.

Breaking down the revenue, energy sold contributed ₦35.8 billion, while capacity charges made up ₦19.9 billion.

The strong performance translated into a 75.4% rise in after-tax profit, which increased to ₦9.7 billion compared to ₦5.5 billion a year earlier.

Nigeria’s electricity needs continue to grow rapidly, fueled by a fast-expanding population, rising incomes, and urbanisation. According to estimates from the Nigerian Electricity Regulatory Commission (NERC), electricity demand, which exceeded 40 terawatt-hours in 2023, is projected to reach 45,662 megawatts by 2030.

While revenue surged, Geregu Power also faced higher costs. Administrative expenses edged up to ₦2.64 billion from ₦2.39 billion last year. Personnel expenses totaled ₦679 million, and maintenance costs for machinery and plant stood at ₦369 million, slightly lower than ₦388 million recorded in Q2 2024.

The company reported a foreign exchange loss of ₦4.6 million under other income, reflecting persistent macroeconomic pressures in Nigeria. Additionally, finance costs rose by 31.6% to ₦3.37 billion, mainly due to increased interest expenses on borrowings, bonds, and receivables.

On the balance sheet, Geregu Power’s total assets expanded to ₦267 billion from ₦207 billion, while total liabilities grew to ₦216 billion compared to ₦162 billion last year. Shareholders’ equity also improved, rising to ₦51.4 billion from ₦45.1 billion.

In terms of cash flow, the company generated ₦29.6 billion in net cash from operating activities during the six-month period, a significant turnaround from a negative ₦5.14 million in the prior period. Net cash from investing activities declined to ₦1.04 billion, down from ₦4.25 billion, while financing activities saw an outflow of ₦31 billion, reversing the ₦30.8 billion inflow recorded in the first half of 2024.

As a result, cash and cash equivalents fell to ₦39.5 billion, compared to ₦43.3 billion previously.

As of July 11, Geregu Power’s share price stood at ₦1,141.50, slightly lower than the ₦1,150 price on January 31, bringing its market capitalisation to ₦2.85 trillion. The modest decline reflects cautious investor sentiment amid foreign exchange and fiscal uncertainties.

Post Comment